Key Insights

Agentic AI is transforming customer segmentation in banking by enabling real-time data processing and dynamic insights. This technology allows banks to tailor services and marketing strategies to individual customer needs, enhancing personalization and engagement. With improved accuracy and efficiency, banks can proactively identify trends and risks, ultimately fostering stronger customer relationships and increasing retention rates.

As the banking landscape rapidly evolves, the ability to understand and cater to diverse customer needs is more crucial than ever. Traditional segmentation methods often fall short in handling the vast amount of data generated in today’s digital world. Enter AI agents—intelligent systems designed to transform customer segmentation in banking. By analyzing complex datasets in real-time, AI agents provide banks with deeper insights, enabling personalized services and more strategic decision-making.

This blog delves into how AI agents are revolutionizing customer segmentation, paving the way for more agile, data-driven banking solutions.

What Is Customer Segmentation?

Customer segmentation in banking is the process of grouping common demographies of customers, behavioral characteristics in transactions, and financial needs. Thus, it means the banks group their customers and pitch their products, services, and marketing strategies to specific groups for optimum customer engagement and profitability. It has been determined that traditional types of segmentation are cumbersome and do not keep pace with changes in the market. However, better and deeper insights are offered by segmentation processes through agentic AI and autonomous operations tracking real-time adaptability.

A Brief Overview of AI Teammates in Customer Segmentation

An AI agent is an intelligent software entity designed to perform tasks, make decisions, and solve problems using predefined rules or machine learning models. It can process large datasets, learn from interactions, and adapt to changing environments, operating independently or as part of a collaborative system where multiple agents work towards a common goal.

In banking, these intelligent systems greatly enhance the analysis and categorization of customers. By utilizing advanced algorithms, they automatically process vast amounts of customer data, including transaction histories, demographics, and spending behaviors. They autonomously identify patterns, predict future customer actions, and segment customers into specific groups based on their unique profiles. This automated and intelligent approach enables real-time segmentation that is both highly accurate and dynamic, allowing for personalized service offerings, improved marketing strategies, and an enhanced customer experience.

Comparison between Traditional vs. Agentic AI Customer Segmentation

The transition from traditional customer segmentation to agentic AI-based segmentation highlights significant advancements in efficiency, accuracy, and personalization. Understanding these differences is vital for financial institutions looking to effectively integrate AI agents, enabling them to better meet customer needs and enhance overall service delivery.

|

Aspect |

Traditional Customer Segmentation |

Agentic AI-Based Customer Segmentation |

|

Data Processing |

Manual or semi-automated, limited to smaller datasets. |

Fully automated, capable of processing vast datasets with real-time analysis. |

|

Customer Insights |

Based on historical data, often lacks predictive power. |

Generates predictive insights using advanced AI algorithms for future behaviors. |

|

Personalization |

Limited personalization due to manual processes. |

Highly personalized services driven by machine learning and autonomous agents. |

|

Scalability |

Time-consuming and challenging to scale. |

Easily scalable and adaptable to growing customer bases without extra resources. |

|

Operational Efficiency |

Requires significant human intervention for data handling. |

Operates autonomously with minimal human oversight, enhancing efficiency. |

|

Adaptability |

Slow to respond to changing customer behaviors. |

Dynamic adaptability through agentic workflows, responding in real-time. |

|

Accuracy |

Subject to human error and limited by static analysis. |

Highly accurate segmentation based on AI's ability to identify patterns. |

How Do AI Agents Facilitate Customer Segmentation in Banking?

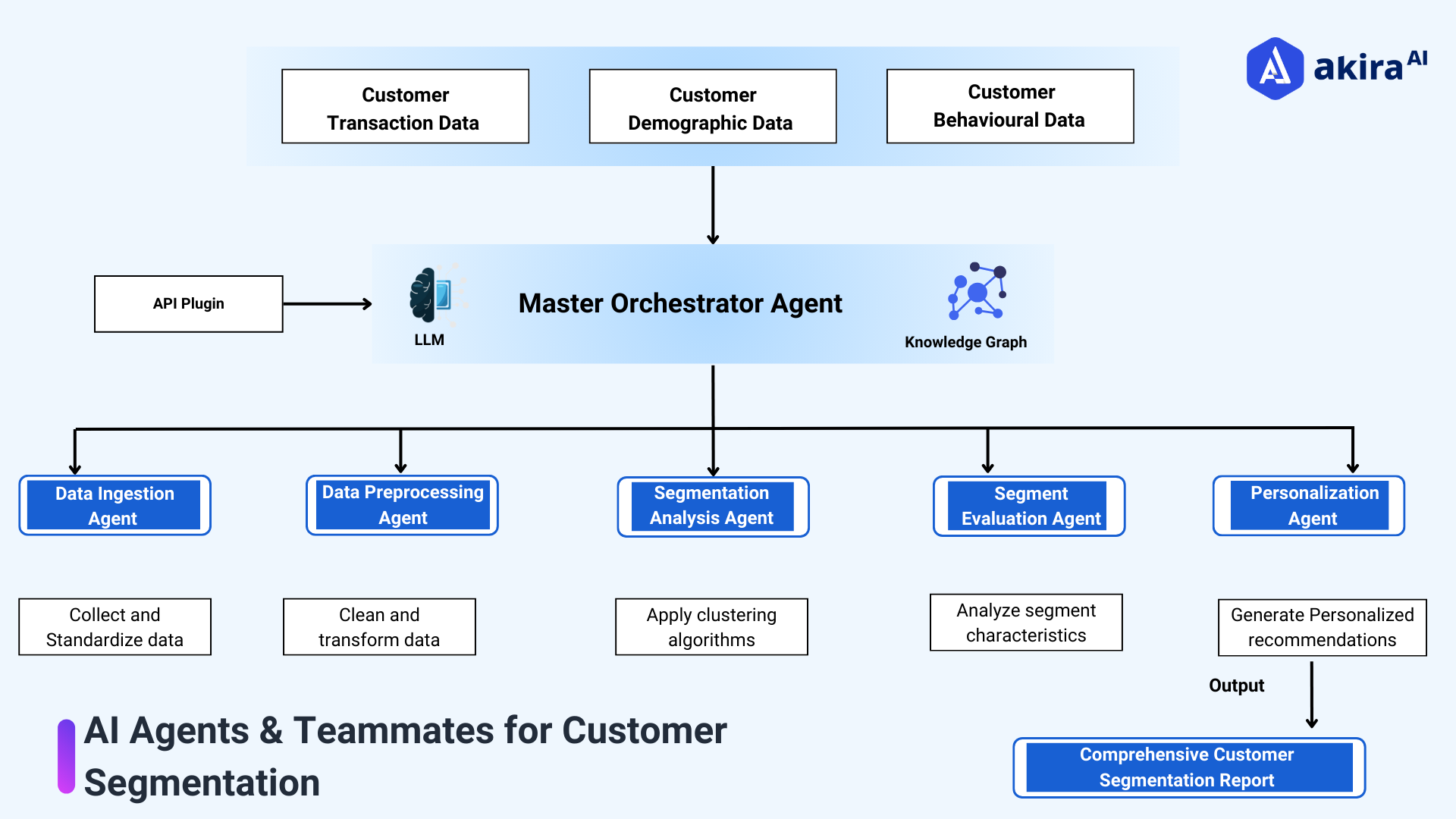

Fig 1: Architecture Diagram of AI Agents for Customer Segmentations

Fig 1: Architecture Diagram of AI Agents for Customer Segmentations

-

Data Ingestion and Preprocessing

The process begins with the collection of various types of customer data (transaction, demographic, and behavioral). This data is fed into the system through a Data Ingestion Agent, which then passes it to a Data Preprocessing Agent. These AI agents work autonomously to collect, standardize, clean, and transform the data, exemplifying the concept of agentic workflow in data preparation.

-

Orchestration and Control

At the core of the system is a Master Orchestrator Agent, which oversees and coordinates the activities of all other AI agents. This demonstrates a key aspect of autonomous operations, where a central AI entity manages complex workflows without constant human intervention.

-

Segmentation Analysis

The preprocessed data flows to a Segmentation Analysis Agent, which applies clustering algorithms to group customers based on similar characteristics. This is followed by a Segment Profiling Agent that analyzes the characteristics of each segment. These specialized AI agents showcase how different types of AI agents can be deployed for specific analytical tasks.

-

Evaluation and Personalization

A Segment Evaluation Agent assesses the quality and value of each customer segment. Simultaneously, a Personalization Agent uses this information to generate tailored recommendations for each segment. This step highlights the use of agentic AI in making autonomous decisions and creating personalized outputs.

-

Report Generation

The final output is a Comprehensive Customer Segmentation Report, which compiles all the insights and recommendations generated by the various AI agents throughout the process.

Use Cases of AI Agents in Customer Segmentation in Banking

Fig 2: Use Cases of Agentic AI in Customer Segmenation

Fig 2: Use Cases of Agentic AI in Customer Segmenation

-

Behavior-Based Segmentation: Customer transaction histories, online behaviors, and social media interactions reveal distinct behavioral segments. This allows banks to tailor financial products and marketing strategies to specific customer needs, enhancing personalization and engagement.

-

Risk-Based Segmentation: Credit history, income, and spending patterns categorize customers into risk profiles. This segmentation enables banks to create targeted lending solutions and risk management strategies, improving credit decision-making and minimizing defaults.

-

Customer Journey: Financial lifecycle stages, such as young professionals, families, or retirees, form the basis for customer grouping. By providing relevant financial products and services for each stage, banks can foster long-term relationships and improve customer satisfaction.

-

Regional Profiling: Location data forms the foundation for regional customer groupings. This insight allows banks to customize offerings and marketing strategies for different areas, optimizing branch operations and service delivery to meet local preferences.

-

Churn Prediction: Behavior patterns and customer sentiment indicate which customers are most likely to leave the bank. By identifying at-risk customers, banks can implement proactive retention strategies, such as personalized outreach or tailored offers, to enhance loyalty.

-

Cross-Selling and Up-Selling Opportunities: Customer data reveals potential for additional product sales. By understanding preferences and behaviors, banks can effectively recommend relevant financial products, increasing sales and improving customer satisfaction.

-

Customer Sentiment Analysis: Feedback from surveys and social media provides insights into overall customer sentiment. This segmentation enables banks to identify satisfied and dissatisfied customers, allowing for targeted improvements in service delivery and customer experience.

Operational Benefits of AI Teammates in Customer Segmentation

-

Enhanced Personalization: Super-personalized service and product offerings based on individual customer needs. Increases satisfaction and loyalty as clients feel better understood and appreciated.

-

Data-Based Decision Making: Informed decisions through actionable insights from comprehensive data analysis. Helps identify emerging trends and customer preferences, facilitating strategic planning.

-

Proactive Risk Management: Improved risk assessment and mitigation strategies for different customer segments. Enables more targeted approaches to managing various types of risks.

-

Better Customer Retention: Prediction of customer behavior and identification of potential churners. Allows for focused retention strategies to reduce churn rates and enhance overall customer retention.

-

Enhanced Compliance and Reporting: Streamlined regulatory compliance through appropriate categorization and analysis of customer data. Improves transparency and efficiency in reporting processes.

-

Quality Marketing ROI: More effective targeted marketing campaigns due to accurate customer segmentation. Proper messaging to the right audience increases the efficiency of banks' marketing strategies.

Technologies Transforming Customer Segmentation in Banking with AI Agents

- Machine Learning Algorithms: These enable predictive analytics by continuously improving segmentation accuracy through the identification of patterns in historical data.

- Natural Language Processing (NLP): This technology analyzes customer communications to extract behavioral insights, helping to understand sentiment and intent for more nuanced segmentation.

- Big Data Analytics: It processes vast amounts of structured and unstructured data, enhancing segmentation by identifying correlations and trends within the data.

- Cloud Computing: This facilitates real-time data processing and scalable storage solutions, allowing for efficient management of customer data and dynamic segmentation.

- Autonomous Agents: These automate decision-making and data analysis, improving operational efficiency and enabling rapid responses to customer needs.

Future Trends in AI Agents for Customer Segmentation in Banks

-

Hyper-Personalization: The banks will, instead, develop rather very niche products that serve a customer's specific needs. By such minute customer profiles and preferences, the banks gain detailed customer satisfaction and retention. This tendency, therefore, forms a more customer-centric approach towards banking.

-

Real-Time Fluidity: Customer segmentation, then, will have to move from static to dynamic models, which are adjusted in real-time. Instant updates of customer interactions through continuous analysis allow banks to update segments instantly. This adaptability makes the marketing strategies more timely and relevant

-

Behavioral Data Integration: The more extensive data on behavior form part of the segmentation strategy. More will be known about customer action than is available today. Motivation about behavior will improve targeting. Better marketing efficacy will result from a proper behavioral-based segmentation strategy.

-

Blockchain and Data Security: It will be an adoption of blockchain technology that increases the security of data during customer segmentation processes. The secure treatment and storage of sensitive information of customers build trust and compliance with regulatory standards. This trend diminishes data privacy concerns and strengthens customer confidence.

Conclusion: AI Agents for Customer Segmentation

The integration of Agentic AI, Agentic workflows, and Autonomous operations into customer segmentation is revolutionizing how banks understand and serve their customers. AI Agents provide unparalleled accuracy, efficiency, and adaptability in segmenting customers, offering hyper-personalized services that traditional methods cannot match. As AI technologies continue to evolve, banks adopting these systems will be well-positioned to meet future challenges and capitalize on emerging trends, driving customer satisfaction and business growth